Investment: retail assets hold firm with stable market share

As European commercial real estate markets adjust, the different asset categories are following diverging trajectories: retail is still in third place, accounting for around 20% of overall investment (vs. 14% at the end of the Covid crisis in late 2021), behind logistics assets, which remain popular, and offices, which are still struggling. Indeed, for the first time, investment in offices and logistics is neck and neck, with each accounting for 25% of overall investment over the last 12 months. After retail premises come hotels, which have flourished on the back of keener investor interest; investment in the category has surged by 40% year-on-year and they now account for 12% of allocations.

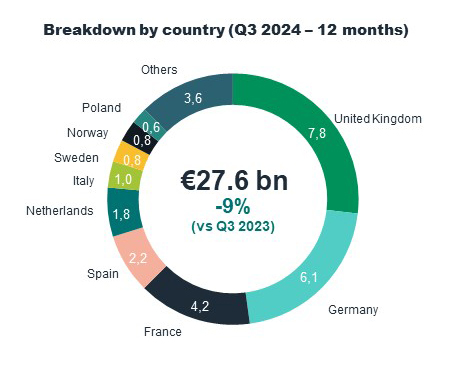

With some € 28bn invested over the last twelve months, investment in retail assets has fallen by an average of -9% in Europe, with divergent market trends. It rose by 10% in Germany, fell slightly in the United Kingdom (-3%) and continued to slide in France (-18%). Together, these three countries account for two-thirds of investment in retail premises. We also note strong growth in Italy (+272%), thanks to a record-breaking deal on Via Monte Napoleone, and in Spain (+47%), where investors are currently showing a keen interest in shopping centres.

A closer look at the different retail market segments shows that the street-level sector is up sharply on last year (+29%), with investment totalling € 8.6bn in the main European countries[1]. Around half of this investment was by luxury retailers.

Investment in out-of-town retail over the last twelve months came to € 7.1bn. Although this segment is down 26% vs. end September 2023, it is still highly sought after by investors, particularly for food-dominated assets.

Lastly, the shopping centre segment saw a slight fall of 5% vs. 2023, with € 4.5bn invested.

Yield expansion is coming to an end

“The adjustment phase following the swift increase in risk-free rates in 2022 and 2023 appears to be drawing to a close. Prime yields for out-of-town retail premises and shopping centres are virtually stable on average year-on-year and offer investors a particularly attractive risk premium; the highest of all real estate asset categories”, remarks Patrick Delcol, Head of European Retail for BNP Paribas Real Estate.

[1]Germany, Spain, France, Italy, Poland and the United Kingdom

The lowest yields are for street-level stores, even though they have widened in recent years. This reflects the buoyancy of transactions in the luxury sector, which is particularly resilient to crises. However, this is a niche market and not representative of the trend in mass-market streets.

Although we expect institutional investors to remain on the sidelines in 2025, value-add and opportunistic investors may seize attractive opportunities over the next few months, with improved operating performance thanks to lower borrowing costs and higher disposable income.

“In the months ahead, this could mean that the retail sector attracts a greater proportion of commercial real estate investment”, points out Patrick Delcol.

Occupier markets still driven by tourism and luxury goods

The robust tourism trend has continued in 2024. According to the World Tourism Organisation, Europe saw a 5% increase in the number of international arrivals over the first seven months of the year, representing 99% of 2019 visitor levels. Global tourism is a major contributor to European economies, with revenues estimated at almost € 630bn in 2023 (+12% vs. 2022).

“These tourist numbers are good for retail footfall in Europe's city centres. There has been no weakening in demand for ultra-prime locations, quite the opposite in fact. For example, rents on the main luxury thoroughfares have risen by an average of 11% year-on-year in the main European markets. This illustrates the strength and appeal of the luxury sector, driven by an international clientele that values prestige and quality”, observes Patrick Delcol.

Bond Street dominates the London market, with rents estimated at over € 30,000/sqm/yr, up 19% year-on-year. Luxury brands are jostling to secure scarce and prestigious pitches in this iconic district, such as the very recent opening of the first London flagship store for Jacquemus.

Rents in Milan remain stable at a high level, at € 13,000/sqm/yr on Via Monte Napoleone. Paris too remains vibrant, with rents reaching € 14,000/sqm/yr, reflecting the city's economic vitality and tourist appeal.

There have also been increases in other European cities, such as Berlin, Munich and Rome, underlining the strength of luxury markets in Europe's largest cities.

“More generally, the macroeconomic outlook, with cuts to central bank interest rates that began last June and inflation gradually returning to reasonable levels, should boost consumer purchasing power in 2025 and benefit retailers”, concludes Patrick Delcol.

- Amira TAHIROVIC