With a 3% difference between the Q1 2017 results, the total real estate investment in Europe for Q1 in 2018 reached €51.3bn.

This shows great potential, particularly when compared to 2017, which broke Europe’s all-time record for real estate investment.

The four main German markets started well (+50% in all except Berlin, -10%). This was driven by single deals, rather than a trend for portfolios which has been seen in recent years. Central London, which saw the sale of a number of trophy assets in 2017 has seen a drop of 42% compared to Q1 2017. Despite this, it remains the biggest European investment market. Central Paris has improved by 12% compared to 2017 and Brussels with a 245% increase moved up to 5th place.

In fact, the 15 largest city markets monitored by BNP Paribas Real Estate posted a 2% growth in comparison to 2017, reaching €18.3bn

Invest in London

Concerns about how Brexit would affect the property market in London seem to have evaporated as foreign investors continued to dominate the market, accounting for more than 80% of the capital turnover in the English capital. For example, after the Brexit vote in 2016, prime office yields experienced a slight growth but then stabilised, confirming the temporary effect of the situation.

Foreign investment has been key to reprising London’s commercial market, Asia and Pacific investment in Europe almost doubled in 2017, overtaking North America for the first time. The UK was the main focus for Asian investors as they invested €14.7bn, targeting mainly trophy assets such as the Walkie-Talkie and Cheesegrater buildings in the City of London.

Of all the sectors, the office sector remained the largest, accounting for 38% of investment volumes.

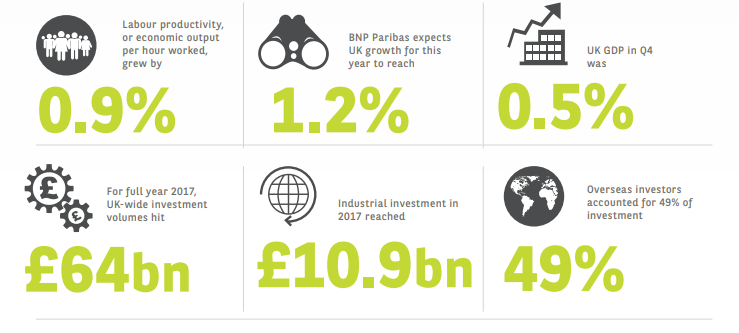

Whilst the UK economy will continue to be affected by some uncertainty over Brexit, BNP Paribas Real Estate predicts that the market will see a 1.2% growth. Latest figures also show UK productivity increasing at its fastest rate in more than six years.

Damian Cronk, Head of Commercial Transactions at BNP Paribas Real Estate comments, “Major global investors, many of which now operate off very long-term time horizons, continue to look beyond the risk of immediate-term volatility with an eye on the UK’s strong underlying fundamentals. The experience of the past few years should remind us, however, to prepare for the unexpected. Looking to the longer term, while there has been some debate regarding London’s future as a global financial centre, many large companies have been expanding their footprint in the capital, seeking to win the technology sector’s fierce war for talent. What they know is that London is built on clay, not sand. ”

Read more UK Investment reports here.

Invest in Dublin

For the fourth year in a row, Ireland is the fastest growing economy in the European Union, growing by an estimated 7% in 2017 and increasing investor confidence in the Irish commercial real estate market.

Strong activity in the final quarter of 2017 (€972m), brought turnover for the year to €2.3 billion, the fourth consecutive year where the total value of turnover exceeded the 10-year average of €1.8 billion. There is subsequently evidence that a pool of international investors are considering investment in the Irish market, based on increasing demand.

Demand for retail assets is a key part of the market, with €3 billion being spent from 2016 – 2017 in Irish shopping centres. Companies who have chosen to locate parts of their business in Dublin cite a rich and diverse talent pool, operating business environment and accessibility as reasons for their move.

Predictions for the economy in 2018 are favourable, with the Central Bank of Ireland expecting GDP to increase by 4.4% in 2018, after a 7% increase in 2017. This bodes well for investors feeling secure within the commercial property market.

Dublin, situated on the estuary of the River Liffey and covering 115 square kilometres has developed a reputation as hub for Financial Services and FinTech, Technology and International Operations centres.

At present, Dublin office space is more in demand than ever before, with take up being 40% higher in 2017 than in 2016. Shopping centres and retail parks are now effectively fully occupied.

The strength of the market is leading to occupier demand broadening within the city of Dublin, with take-up extending to the city edge and suburban districts. Like in many other European cities, one key trend in 2017 was the emergence of co-working office trends, which will undoubtedly continue to grow in 2018.

Keith O’Neill, Executive Director Office Agency at BNP Paribas Real Estate Ireland notes, “With unemployment figures now as low as 6%, recruitment is becoming an increasingly important consideration for occupiers and many TMT occupiers are using their real estate to attract and retain staff in a very competitive sector.”

Read the full Investing in Dublin 2018 report here.

Invest in Munich

With a GDP of nearly €3.3tn in 2017, Germany is the strongest economy in Europe.

Whilst prime rents rose by an average of 5% in 2017, office rents in Germany are still significantly lower than those in Central London or Paris. During 2017, investment activity remained dynamic and Germany established itself as a dominant investment market with the second-best market share in Western Europe after the UK. Of the 14 primary investment markets in Western Europe, four are located in Germany (Frankfurt, Munich, Hamburg and Berlin).

Germany’s third largest city and capital of the federal state of Bavaria Munich, lies 30 miles from the north edge of the Alps. Munich is an incredibly attractive location within Europe in terms of investment, particularly for technology and electronics companies. With a population of 1.5 million, Munich combines a healthy, future-orientated economic structure with easy access to both the Alps and the Mediterranean.

Munich combines a number of key industries; electronic media industry and research establishments. Average take up of office premises over the past ten years has been above 720,000 sqm, putting it first in terms of take-up amongst other Germany cities.

Munich is a very stable place to invest, with an investment turnover of €4bn and foreign investors accounting for an average share of 40% aggregate turnover. This upholds Munich’s reputation as a safe haven for real estate prices, attracting both private investors and family offices. Renting in Munich offers long-term stability and low volatility.

Sven Stricker, Managing Director, Co-Head Investment at BNP Paribas Real Estate Germany, sums up the German investment market by saying, “The structure of the German markets opens up opportunities for virtually the entire spectrum of investors.”

Read the full Guide to Investing in Germany 2018 report here.

Other content you might like:

- Logistics in real estate: we take an in-depth look at the sector

- BNP Paribas Real Estate presents H1 2017 European Logistics Market report

-

PropTech; what will the real estate sector look like in five years?

Find out more about our Investment Management and Property Development divisions.