Business continues to grow in a favourable climate

Unlike 2015, most French cities have seen a rise in employment levels in 2016 with around 120,000 new jobs created, while household consumption has remained robust. The latest BNP Paribas estimates forecast GDP growth of 1.3% for 2016 and 1% for 2017.

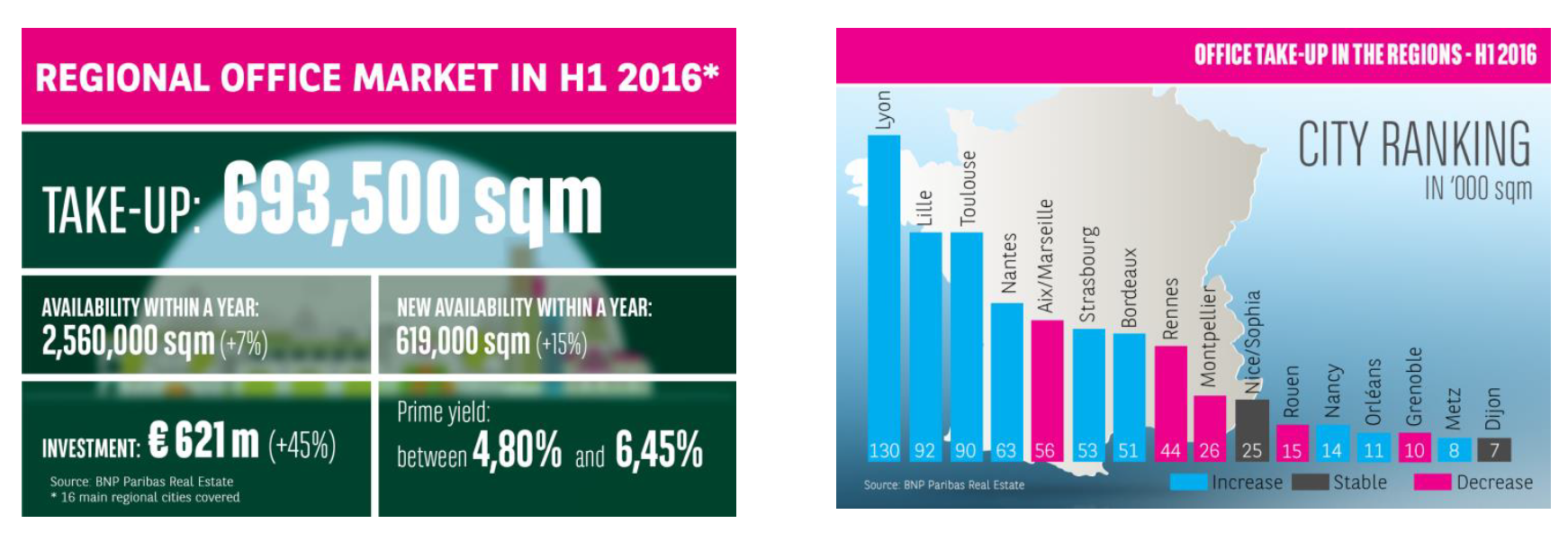

“The market is at a historical peak with take-up reaching 693,500 sqm in H1 2016 in the 16 main regional cities covered*, up 24% vs. H1 2015”, summarises Jean-Laurent de La Prade, Deputy General Manager of BNP Paribas Real Estate Transaction France.

Three regional cities stand out thanks to a substantial rise in their take-up: Lyon (+76%), Nantes (+91%) and Strasbourg (+135%). Yet these are not the only cities to have seen increases, with Lille (+51%), Toulouse (+30%), Bordeaux (13%), Orléans (+59%), Metz (+55%) and Nancy (+56%) all seeing take-up rise. Conversely, Rennes (-6%) and Dijon (-6%) saw slight declines, and four other cities showed a more pronounced decline: Aix-Marseille (-24%), Montpellier (-34%), Rouen (-41%) and Grenoble (-32%). Only Nice-Sophia saw no change.

“We may therefore match the record performance of 2007, with take-up breaking through the 1.5 million sqm threshold”, says Jean-Laurent de La Prade.

Take up increases across all unit sizes

While the take-up of small units (< 1,000 sqm) remained solid, the striking aspect of H1 was the increased take-up of medium-sized units: “Whereas for a number of years the 1,000 – 5,000 sqm segment has been dwindling, it enjoyed spectacular growth in H1 2016 (+52%). It now represents a third of take-up vs. one quarter last year”, explains Jean-Laurent de La Prade.

Faced with a shortage of new supply, occupiers switched to second-hand options. Over the first six months of the year, transactions in second-hand offices increased by 32%, vs. 15% for new offices. Landlords doubtless made efforts to refresh their premises and bring them up to standard.

It is also significant that, unlike last year, deals for new premises were not particularly driven by owner/occupier or rental turnkey deals, but instead concerned mainly available supply.

*Aix-Marseille, Bordeaux, Dijon, Grenoble, Lille, Lyon, Metz, Montpellier, Nancy, Nantes, Nice/Sophia, Orléans, Rennes, Rouen, Strasbourg and Toulouse

“With respect to business sectors, the market is therefore more homogenous, compared to the last year, with the share of industry and the public sector declining in favour of all the other segments”, adds Jean-Laurent de La Prade.

The amount of office space in the regions that is available within a year has risen by 7% since the end of 2015, to 2,560,000 sqm. New supply has risen by 15% to 619,000 sqm, the biggest rise since 2008, with growth expected to continue in the major cities. Indeed, there are major schemes being developed in the big cities, notably well-anchored city centre projects like Euroméditerranée and Euronantes as well as sites getting underway such as Euratlantique in Bordeaux or Eurorennes, together with other longer-term projects like Toulouse Matabiau. All of these schemes will boost new supply.

Office investment in the regions increased by 45% in H1 2016 vs. H1 2015 with a total of € 621m invested. It is a two-speed market – on the one hand there is the prime market favoured by institutional investors and characterised by a continued fall in yields in a context of rising inflows and very strong demand. On the other hand, there are Core + or value-added assets for which yields are starting to compress. To contend with the fall in yields, investors are opting for higher-risk off-plan sales and diversifying to industrial premises, for example. Another trend is the development of rental turnkeys across the country. In Lyon, the market remains buoyant, with € 338m invested in offices in H1, including three deals for over € 50m. Despite a recurrent lack of available assets, investors appreciate the depth, readability and tight management of these assets.

The office market in the regions is accelerating faster than European counterparts

“Office take-up in the French regions has risen by 24% over the last 12 months, whereas in parallel, growth in comparable European markets is limited to 10%. Prime rents in the French regions have gained an average of € 21/sqm on pre-crisis levels, whereas the biggest European markets have gained an average of € 9 and foreign regional markets have lost €13/sqm compared to July 2008”, concludes Guillaume Delattre.

- Amira TAHIROVIC