- Logistics take-up for warehouses over 5,000 sqm: -14% in H1 2018 vs H1 2017

There is no surprise to see a slump in take-up compared to the historic volume achieved in 2017. The logistics occupational market is still strong though and above its 5-year average mark. Some countries like Spain, Germany and the Netherlands even managed to at least level their historical volumes of transactions.

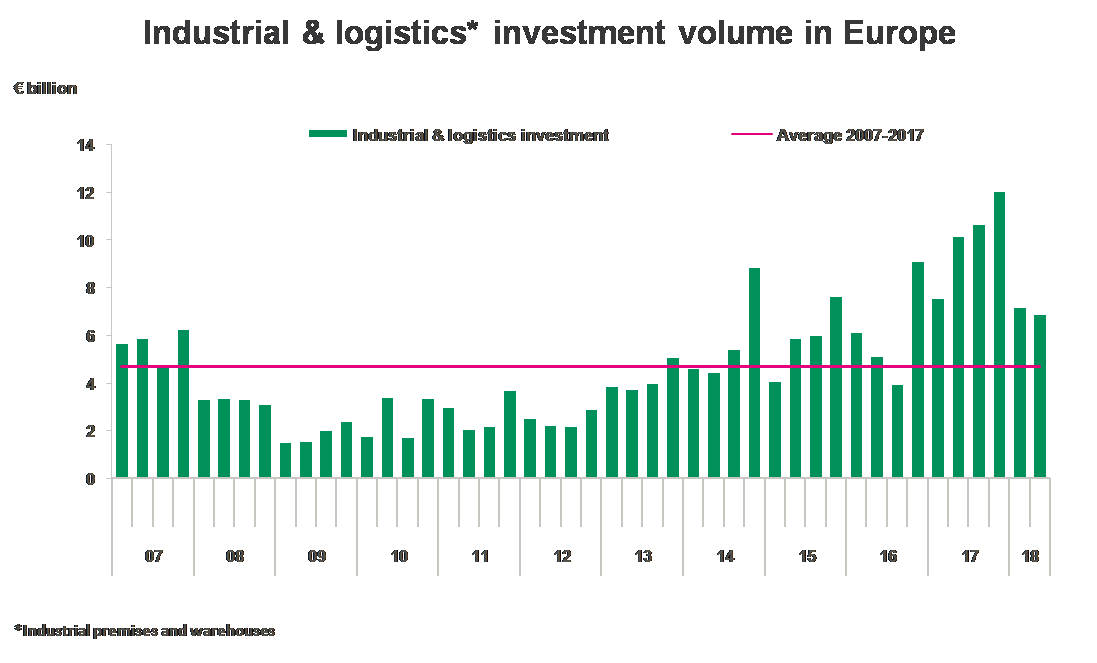

- Industrial and logistics investment: €14 billion, -21% in H1 2018 vs H1 2017

The investment market adjusted down following the exceptional volumes achieved in 2017. Yet, investor interest is not fading: the market for industrial and logistics premises reached its second highest mid-year volume of investment.

Take-up: good momentum again in the first half of the year

After the record volumes of take-up achieved in Europe over the past three years, it is not surprising to see a market slowdown during the first half of 2018. In 20 cities monitored by BNP Paribas Real Estate, the volume of take-up dropped by 14% in H1 2018, yet the market is sustaining a high level of activity.

The main factor contributing to this positive market dynamics is GDP growth in the Eurozone (2.2% this year and 1.7% in 2019 according BNP Paribas’ forecasts), supported by domestic demand, manufacturing output and international trade. E-commerce activities also stimulated market growth in the main European logistics hubs. This sector recorded a 14% increase in Europe in 2017 and is expected to further enjoy a two-digit growth in 2018.

Germany and the Netherlands recorded another good start to the year with strong activity, while in France, following strong growth for 3 years in a row, the market went down during the first half of 2018. The UK market remained dynamic with 1.6 million sqm taken up in H1 2018.

In this favourable context, investors and developers’ confidence stimulated new construction including speculative developments. Yet, supply is still barely keeping pace with demand especially for large units, with vacancy rates below 5% in Spain, the Netherlands, Poland, the Czech Republic.

Considering the chronic lack of supply, the effect on rents has been fairly modest, increasing by just 8% over the past five years. In the first 6 months of 2018, rents rose by 2% in the main European markets Europe with some significant growth in Milan, in Berlin and in UK regional cities.

European industrial and logistics investment activity is still thriving in H1 2018

The European investment for industrial premises and warehouses naturally adjusted down after the exceptional volumes achieved in 2017, boosted by the sale of major portfolios and large corporate deals such as Logicor. This impacted most European countries though the adjustment down did not undermine strong activity in H1 2018. Indeed, the market for industrial and logistics premises reached its second highest mid-year volume of investment with €14bn recorded during the first half of 2018.

Anita Simaza, Director for European Logistics Investment said "Financial liquidity remains abundant and, besides pure players, the logistics market is more than ever attracting international investors who consider logistics assets as a way to extend their portfolio holdings. Logistics prime yields reached their lowest level in most countries but are still well above the 10-year government bonds which bottomed out to historic lows in 2016. Then, logistics prime yields remain attractive compared to other assets."

The UK market maintained solid activity with €4.3 bn invested in H1 2018, and logistics prime rents remained fairly stable overall whilst prime yields stabilized at 4.25%.

In Germany, industrial and logistics investment remained very active with €3 bn signed in the first half of 2018. Despite a decrease by some 47% over H1 2017, this represents the second-best result of all time by some distance.

In the Netherlands, industrial and logistics investment increased sharply to €2 bn in H1 2018 (+ 57% over H1 2017). This asset class is particularly strong in the Netherlands representing 25% of total commercial real estate volume in the first half 2018.

The French market amounted €1.4 bn for the first half of the year boosted once again by portfolios deals. In Spain, after two year of unprecedented activity, investment reached €390 million, down 33% on H1 2017. In Poland, investment activity went up significantly to €400 million and the prime yield went down this quarter to 5.25%.

Click here to download the full report

- Amira TAHIROVIC