Office take-up in 2023 dampened by a challenging environment and changing working patterns

The slowdown in rental activity seen from late 2022 in some European markets then spread and was confirmed in 2023. This was due to the uncertain economic and geopolitical context and structural changes in the way offices are used.

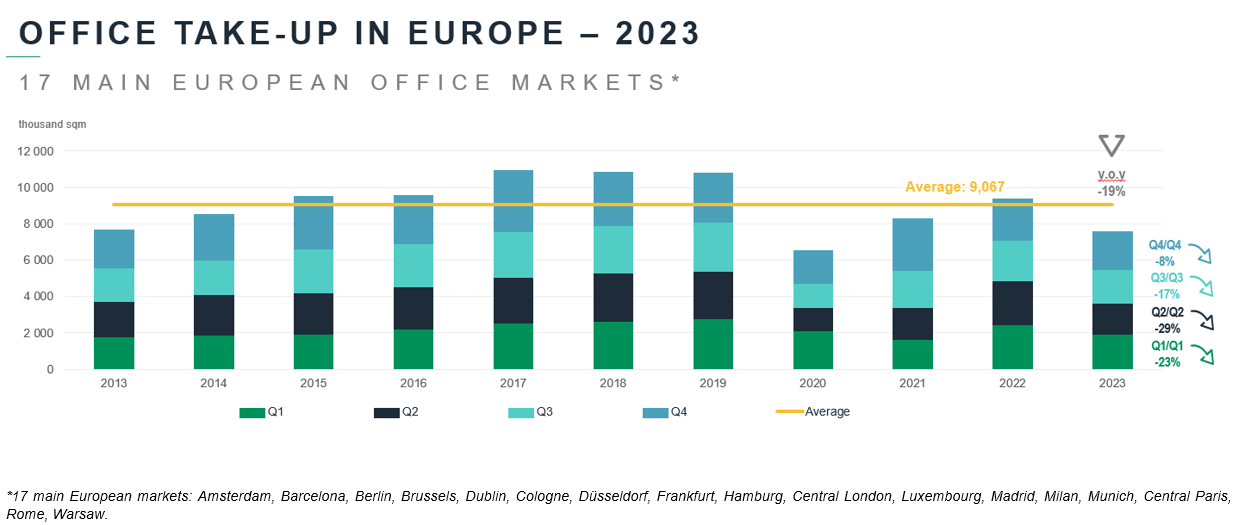

All told, take-up for the year came to 7.6 million sqm across the 17 main European markets*, down 19% vs 2022. This was 16% lower than the long-term average.

According to Thierry Laroue-Pont, CEO of BNP Paribas Real Estate, “2023 will still be looked back upon as a respectable year. After leasing declined due to teleworking and new work patterns, office take-up is now finding a new balance. This has primarily affected large units, while small and medium-sized units have shown more resilience”.

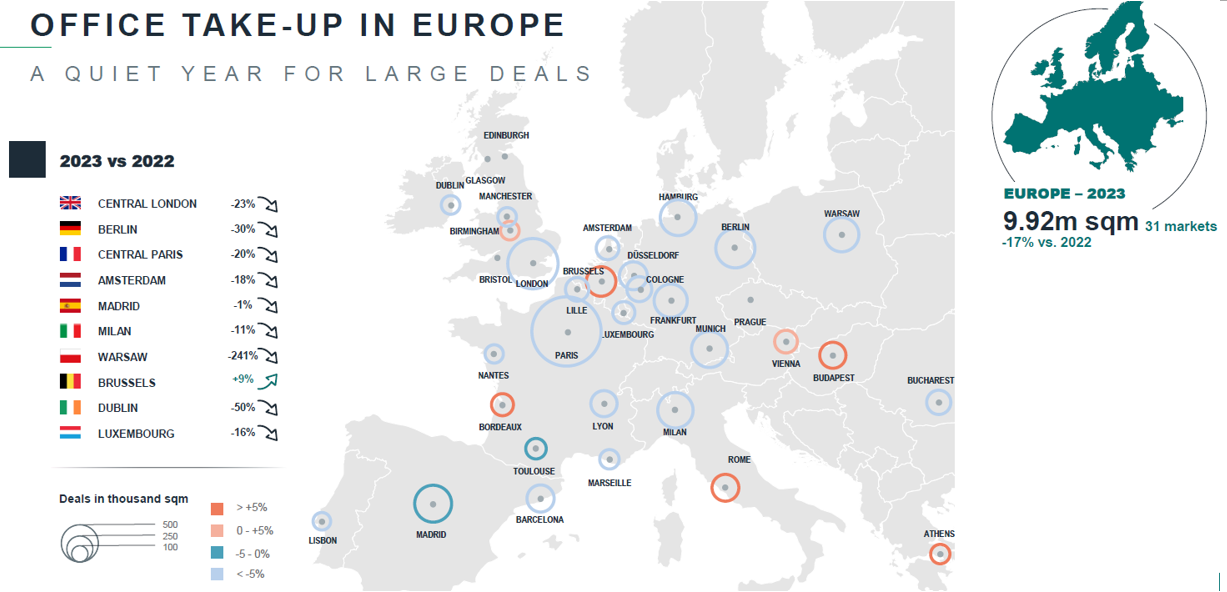

Mixed performances across Europe

The weaker leasing trend is largely due to fewer deals for units over 10,000 sqm.

The six main German markets (Berlin, Cologne, Frankfurt, Düsseldorf, Hamburg and Munich) reported a 26% fall, directly hit by the slowdown in the German economy, while Central London ended the year down 23% and Central Paris down 20%.

Conversely, Southern Europe has been boosted economically by tourism and is enjoying take-up above long-term averages. This is the case for Madrid and Milan which, despite a moderate fall in take-up year-on-year (-1% and -11% respectively), outperformed their ten-year averages by 5% and 20%.

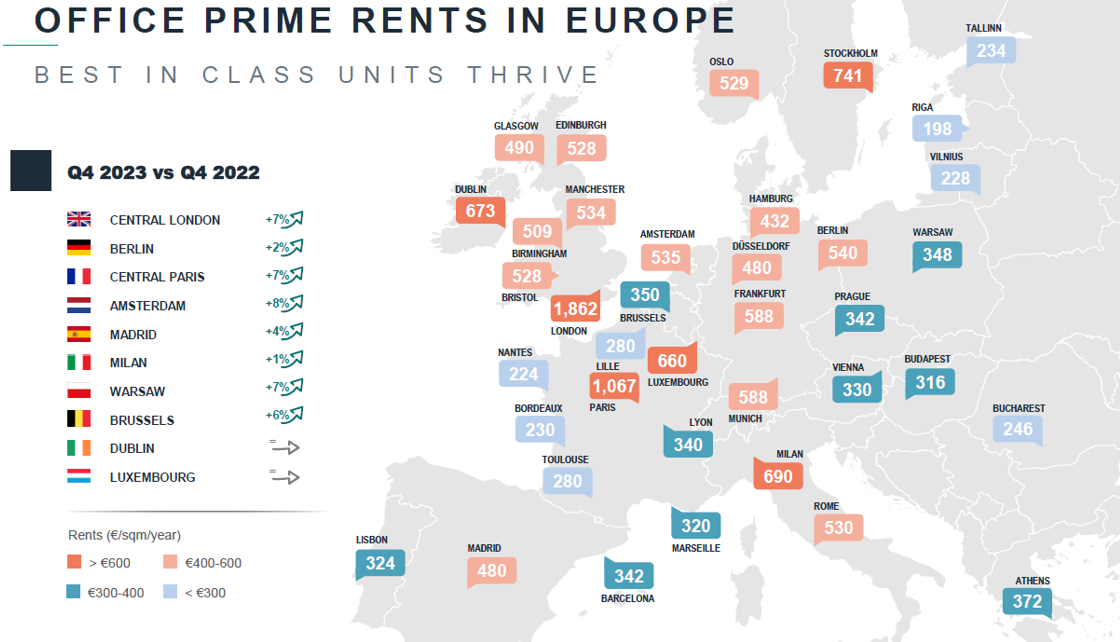

Prime rents underpinned by the quest for the best locations

Occupiers' keen appetite for the most established central locations and flexible, recent buildings continues to support prime rental growth in most European markets. This emphasis on quality is reflected in an average rise in prime rents of 4% over the year in Europe's major cities.

Vacancy rates still at reasonable levels

Although the vacancy rate has risen slightly over the year (+40bp), it is still reasonable (8% on average at the end of 2023). However, this overall trend fails to show major disparities between the most sought-after business districts, which where new supply is short, and certain outlying districts and/or second-hand assets, which are contributing to a growing supply of space that does not meet occupiers' new expectations.

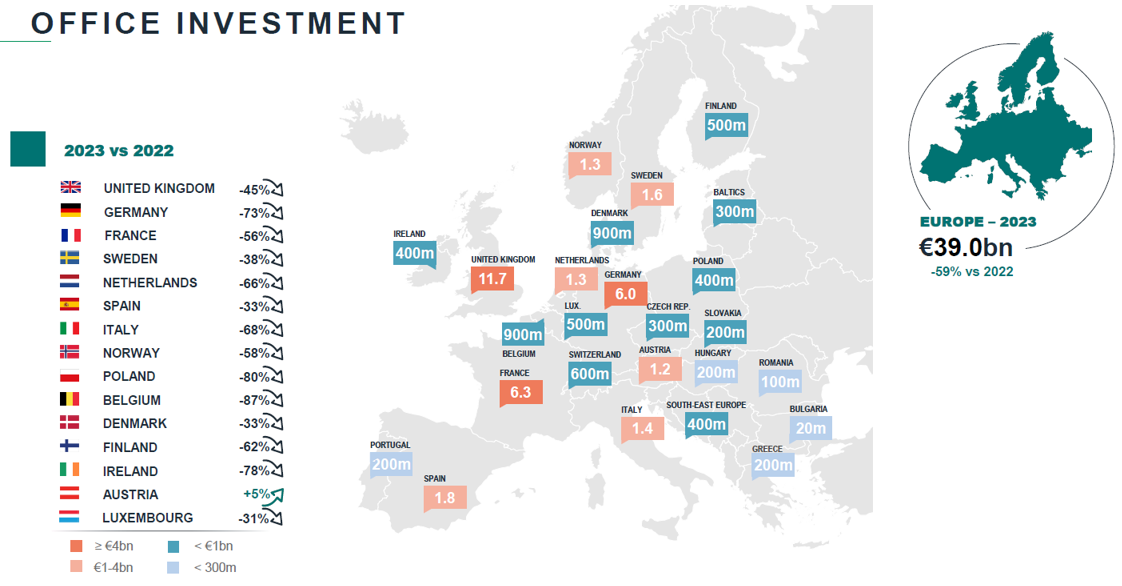

Investment in Europe slowed significantly in 2023

The slide in investment that began in Q3 2022 continued throughout 2023. Higher borrowing costs, combined with the improved yields offered by other financial products and the downward trend in property prices, have prompted investors to take a wait-and-see approach, leading to a fall in investment. A total of just € 133.2bn was invested in commercial real estate in Europe in 2023, down -51% compared with 2022. A fall as dramatic as this has not been seen since 2008. The office sector has been hit particularly hard, with investment down 59% to € 39bn. No European country escaped this trend: investment in offices fell by 73% in Germany, 45% in the UK and 56% in France. Spain (-33%), the Netherlands (-66%) and Italy (-68%) were also hit hard.

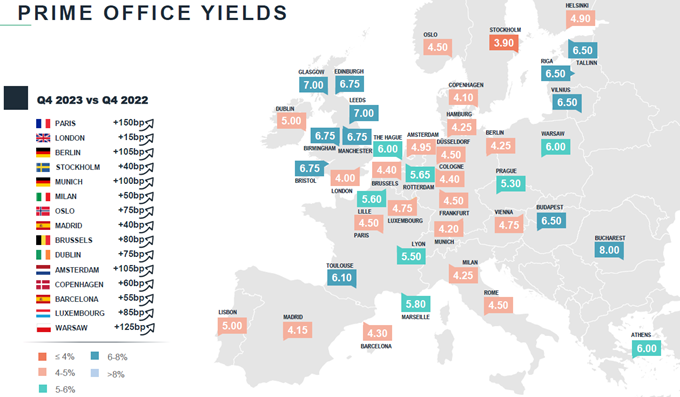

Prime office yields still expanding

Despite the contraction in government bond yields in December 2023, office yields continued to widen in Q4. Over the full year, prime yields have widened by an average of 100 basis points in Europe. The greatest prime yield expansion among the capitals of Europe was in Paris, where it increased 150 basis points over the year.

"Thanks to these increases in real estate yields, as well as the swift contraction of bond yields following recent statements by central banks, the real estate risk premium has begun to recover. However, investors will only start gradually returning to real estate once bond yields stabilise", concludes Thierry Laroue-Pont.

- Amira TAHIROVIC